Learn

Looking for more information?

Contact our responsive and friendly client services team any time.

Bidding

Last updated 2 years ago

How does allocation work?

Allocation occurs once all bids are final and submitted to the lead manager. It represents the amount of shares that the company has allocated to investors that have bid into the offer.

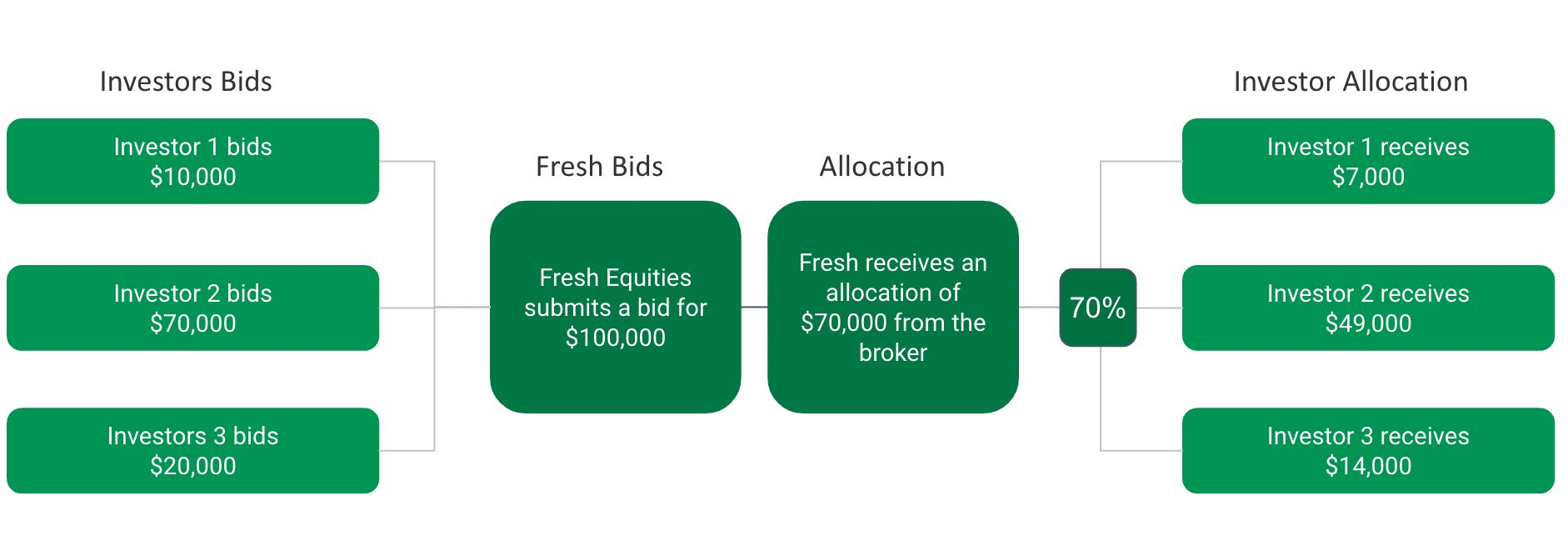

The allocation is the amount of shares that the company has allocated to investors who have bid into the offer. Allocations can be equal to, or less than, your bid amount depending on how the company chooses to distribute shares across the bids. Allocation decisions are made at the discretion of the company. Fresh Equities allocates to our investors on a pro rata basis, unless otherwise advised by the raising company.

Once your bid is confirmed, Fresh Equities submits the aggregated bid of all of our participating investors to the lead manager as an institutional bid. Usually, companies will appoint a lead manager to run their capital raise, but still manage a portion of the book themselves.

Check out how bidding works here.

Check out how Fresh participates in bookbuilds here.

What is the Bookbuild?

The bookbuild refers to the process undertaken by a company and/or the lead manager of the raise to determine the structure and composition of bidders for a capital raise. The desired composition of the book can be effected by many variables including the relationship with the raising company or lead manager, existing holders, holding intentions and investment thesis.

Bidding to Allocation

Once Fresh receives an allocation from the lead manager, Fresh will send out an allocation notification and offer letters to all investors outlining their allocation in AUD and shares and all other important information such as settlement and payment instructions, the structure of the raise and key dates.

There are two methods that placements will settle by. See what comes next in both settlements processes here:

Ultimately, allocation is at the discretion of the company and therefore Fresh can never fully guarantee allocation.

Fresh is always looking out for the interests of our investors and therefore does not take any positions in the deals that we get access to - the allocation we receive from the offer is fully passed on to our investors.

Become a client!

Click here to learn more about the account opening process.

Click here to go straight to creating an account and start bidding with Fresh!

Click here to see the live offers on Fresh.

Some articles you might find useful:

Related readings

Suggested topics

Support

Live Chat

Markets